A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

2023-05-12 • Updated

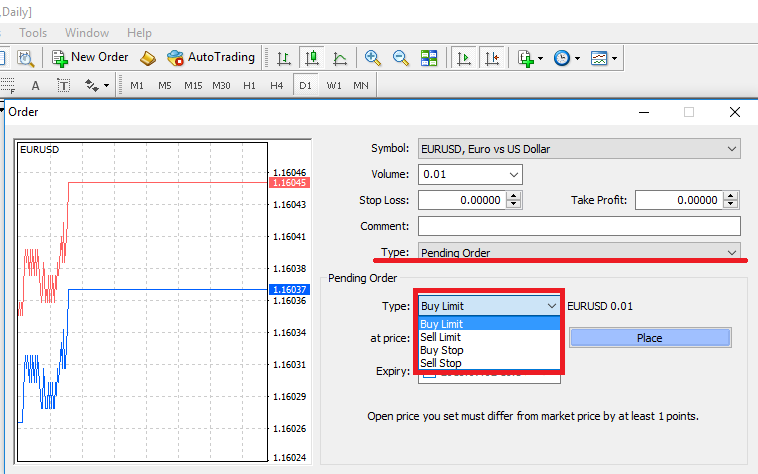

There are situations when you don’t want to enter the market at the price it offers you. Reasons can be different. For example, you know that you can buy the pair at a lower price and you just wait. Or you are not sure about the further direction of the price but know that if the pair reaches a certain level, its further direction will be clear. So, what should you do? Sit in front of a monitor and wait until the price level meets the conditions you want? Definitely not. Pending orders were created for you!

There are two types of the pending orders. They are limit orders and stop orders. As a trader always makes a choice whether to buy or to sell, it’s logical that there are two types of limit orders: buy limit and sell limit. Stop orders can also be broken down into buy stop and sell stop orders.

Let’s start with a limit order.

Imagine that you suppose that although the price is going down now, it will rebound from the certain level and then go up. As a result, you should place a BUY LIMIT order at the price you think will be a reversal point for the price (below the current price). The feature of this type of orders is that you can buy at a lower price.

Vice versa, there may be a time when you see that the price is moving up but you are sure that it will meet a strong resistance, recoil from it and go down. In this case, you should place a SELL LIMIT order above the current price. A feature of this type of orders is that you can sell at a higher price.

Notice that you use limit orders when you expect either a support of a resistance level to hold.

What about another type of pending orders, a stop order?

Stop orders are used when a trader expects the price to get through a resistance or a support level.

Imagine that the price goes up and you are sure that if it reaches a certain level, it will go even further. In this case, you should place a BUY STOP order at the level above the current price.

Conversely, assume the price goes down and you have a perception that after it reaches a certain level it will go down even further. As a result, you place a SELL STOP order below the current price.

You may ask: why should I use the stop order if the price doesn’t rebound and just continues its movement in the same direction? I can buy at the lower price or sell at the higher. There is a hint here. The stop order is used to accurately confirm the further direction of the price. If the pair reaches a certain level, you can be sure it will go further, otherwise, it can rebound before it reaches the level you chose.

An important tip: remember that if the price doesn’t reach the level you chose in your pending, the trade won’t open. A big threat for your profit is hidden here. You must close the order if it was not implemented. Otherwise, you can forget about it and a trade will open at the time when you don’t want it. One of the solutions is to set the expiry time for your pending orders.

Making a conclusion, we can say that pending orders are a great way to reduce your efforts and time in front of the screen. Moreover, pending orders will help to be sure in the future direction of the price and let you enter the market at the most attractive price. This is a great way to make your trading more precise and more profitable!

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

Sometimes a chart or a candlestick pattern may provide a decent entry signal if it is located at a certain level. A pin bar is one of the most reliable and famous candlestick patterns, and when traders see it on the chart, they expect the price to change its direction soon.

Most traders prefer to trade using technical indicators like RSI and MACD. Others love using a bare chart to make their decisions.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!